TEAL Looks to Expand Aerospace Parts Manufacturing Footprint

Enthused by a burgeoning aerospace market in India and globally, TEAL (Titan Engineering and Automation Limited) is looking at expanding its aerospace components and sub-assemblies manufacturing shop floor at its sprawling facility in Hosur.

TEAL, a fully-owned subsidiary of Titan Company Limited, has already envisaged investing more than Rs 400 crore over the next 4-5 years towards expansion, covering its different verticals, including automation and manufacturing, which encompasses its aerospace components and sub-assemblies’ business.

“The aerospace component system manufacturing segment is on an uptick and India is very well-suited to cater to this segment, and we are very good at precision manufacturing,” TEAL CEO and MD Neelakantan P Sridhar told the TNIE. “Typically, our capability lends itself well for components in engine accessories, landing systems, and actuation controls. In all, we make 800-1,000 components today,” he added.

Accordingly, TEAL is a Tier-I supplier to aircraft parts (eg. engine) manufacturers, and Tier-II supplier to aircraft manufacturers. From Pratt & Whitney engine components that power IndiGo’s aircraft, to critical components on an Air India flight and some parts that go into HAL’s light helicopter engine, TEAL has a footprint in the domestic market and across the globe.

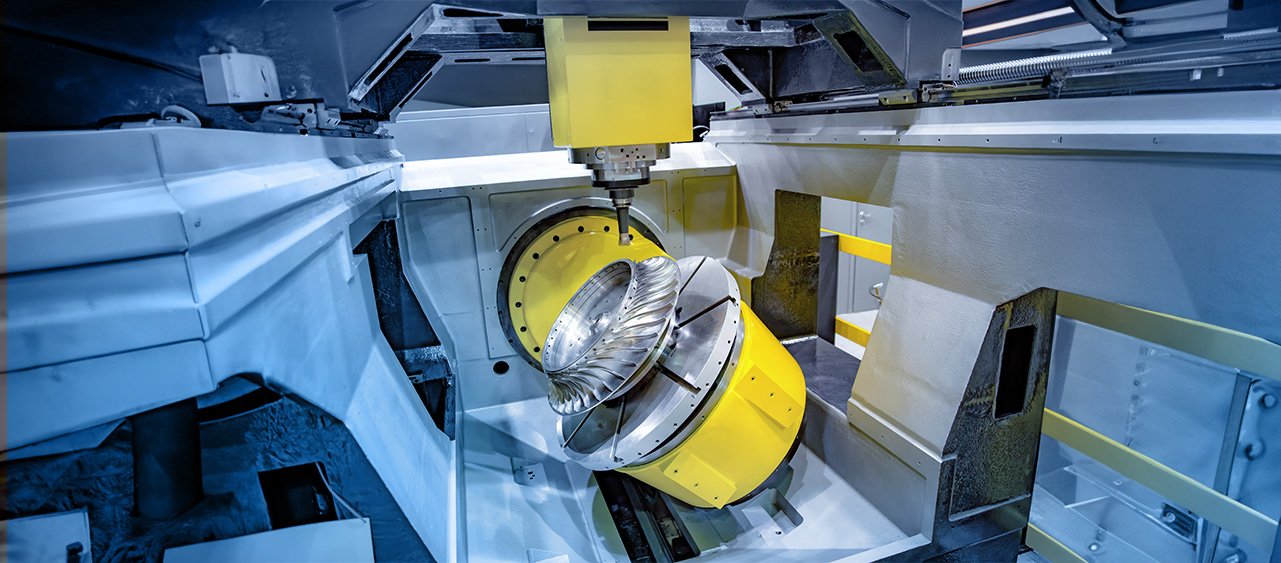

To date, TEAL has served 13 strategic clients in the aerospace industry, including Raytheon. “With each of our customers, we have a lot of opportunities to grow. We are trying to move up the value chain,” said Sridhar. In that direction, as part of its expansion, TEAL will add more than 80 imported CNC machines in the next 4-5 years on its 1,20,000-sq ft ‘Unit 2’ shop floor in Hosur.

A CNC (Computer Numerical Control) machine uses computer-controlled tools to cut, drill, or shape materials, with high-accuracy and precision, and is deployed in the production of precise aerospace components.

Since its inception in the early 1990s, TEAL has carved a formidable niche for itself, beginning with automation, and later foraying into precision manufacturing. Its automation solutions business involves creating modular assembly lines for machine construction for various industries, with demand primarily from the auto industry, more specifically the EV segment. More recently, TEAL also ventured into the wafer fab equipment segment – a part of the semiconductor sector.

Presently, India is well-poised to see heightened demand for air travel, and with more flights, and eventual purchase of more aircraft, the opportunities to build local supply chains are endless. According to Grand View Research, the Indian aerospace parts manufacturing market size was estimated at $13.6 billion in 2023, and is projected to grow at 6.8% CAGR during 2024-30. “The market is driven by an increasing demand for air travel, both domestic and international. As airlines expand their fleets and modernise their aircraft, the demand for high-quality aerospace components is expected to surge,” it said.

Going forward, TEAL is looking at creating solutions for the electronics, solar, electrification, and semiconductor sectors. “We also want to go deeper into North America and Europe. We are looking at more exports, and sense fully-automated solutioning opportunities in the Western markets,” the CEO said.

With revenues to the tune of Rs 761 crore in FY24, TEAL is eyeing Rs 900 crore in FY25, while stepping up capex in automation, semiconductor and aerospace. Around 50% of its business is derived through exports.